How Property By Helander Llc can Save You Time, Stress, and Money.

How Property By Helander Llc can Save You Time, Stress, and Money.

Blog Article

An Unbiased View of Property By Helander Llc

Table of ContentsAn Unbiased View of Property By Helander LlcThe Property By Helander Llc DiariesExamine This Report on Property By Helander LlcNot known Facts About Property By Helander LlcSome Known Facts About Property By Helander Llc.

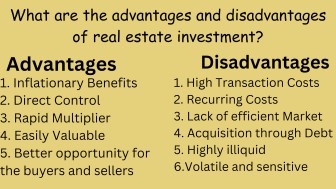

With larger properties, it may take time to discover the best occupant. If one is empty for long, your investment could quickly dip right into the red. You could require to remodel your residential property occasionally to make it a lot more tempting to renters. Although it requires up-front costs, remodeling a lobby, updating components or rehabbing old landscape design can make residential or commercial properties much more attractive and assist justify higher rental fees.Believe concerning the building's prospective gratitude and revenue, the market's performance, and the quality of investors you bring on board. If you want to speak financial investment technique with a professional, reach out to our James Moore advisors.

They can assist you make an investment strategy that makes up all possible risks and benefits. All content given in this write-up is for informative purposes just. Matters discussed in this write-up go through alter. For current details on this subject please call a James Moore professional. (https://www.bark.com/en/us/company/property-by-helander-llc/akobBO/). James Moore will not be held liable for any type of claim, loss, damages or trouble created as a result of any type of information within these pages or any info accessed through this site.

Allow's concentrate on one option: real estate. Discover exactly how real estate financial investments can boost your financial wellness, with a special focus on tax advantages.

Little Known Questions About Property By Helander Llc.

Home mortgage interest deductions can be an advantage to investors whose qualified itemized deductions consisting of home mortgage rate of interest are better than the basic reduction. This tax obligation advantage permits investor to subtract state and neighborhood taxes they pay on financial investment homes from their federal revenue tax obligations. As an example, if you acquired a $750,000 property in San Francisco with an area tax obligation price of.740% of the evaluated home worth, you're checking out $5,550 in local tax obligations (realtors in sandpoint idaho).

Thankfully, the real estate tax reduction allows you to create that quantity off when you file government revenue tax obligations the following year. It deserves bearing in mind that this tax deduction is subject to particular state and neighborhood constraints and restrictions. Ensure to clarify any lingering questions with your tax specialist.

If you actively take part in genuine estate investing, you may have the ability to subtract approximately $25,000 in easy losses1 against your easy earnings. However, this is restricted to investment buildings in which you are currently active. So, if you sell a residential property because it's generating losses, you can no more use this deduction.

Rather than taking a solitary reduction for the year you purchased or made substantial improvements to a residential or commercial property, depreciation allows you to disperse the deduction throughout the building's useful life (approximated years of solution for successful profits generation). Devaluation starts the moment you place a residential property into service. In this instance, as soon as it prepares to be utilized for rental solutions.

The Buzz on Property By Helander Llc

Normally, funding gains taxes are an exhausted percentage that's deducted from the revenue on sales of resources, like actual estate. If you acquired a residential property for $500,000 in 2015 and offered it for $750,000 in 2023, you have actually made a $250,00 profit.

There are methods to take pleasure in the advantages of genuine estate investing without needing you to be actively involved. Below at Canyon View Capital, we comprehend the ins and outs of property investing. That's because, for over 40 years, our experts manage an actual estate profile that has actually grown to over $1B3 in aggregated worth.

When done correctly, genuine estate is among the most prominent and successful investments with a lot of potential for success. Realty investing offers lots of advantages, and financiers can enjoy a steady earnings flow that may bring about economic freedom. You Can Create Easy IncomeBy investing in realty, you can generate passive income that is almost tax-free.

Property By Helander Llc Can Be Fun For Everyone

By getting several rental residential properties that generate adequate earnings to cover your expenses, you have the flexibility to do what you enjoy, rather than spending every one of your time at work. Property investing, when done right, is a steady way to raise riches over a time period. Among the several benefits of realty investing is that it can supply cash circulation for retirement.

Unlike supply market investments, realty investment does not extremely vary each day. It is a stable investment that gives you with an earnings - Sandpoint Idaho land for sale. You just collect your continuous revenue (referred to as Money on Cash Money Return) on a periodic basis and wish to market when the price appreciates significantly and the marketplace is high

There are methods to take pleasure in the advantages of real estate investing without requiring you to be actively engaged. Right Here at Canyon Sight Resources, we understand the ins and outs of realty investing. That's because, for over 40 years, our experts handle a genuine estate profile that has actually expanded to over $1B3 in aggregated worth.

Excitement About Property By Helander Llc

By acquiring several rental buildings that generate sufficient revenue to cover your expenses, you have the liberty to do what you enjoy, instead of investing every one of your time at the workplace. Genuine estate investing, when done right, is a secure way to boost wide range over a time period. Among the several advantages of property investing is that it can supply capital for retirement.

Real Estate Investing Is a Bush Versus InflationWhile most individuals fear inflation, this is not the situation with investor. Purchasing residential or commercial properties view it now is an exceptional bush versus rising cost of living. As the rate degree increases, so does the rental revenue you obtain from your residential or commercial property and your financial investment's value.

Unlike supply market financial investments, property financial investment does not extremely rise and fall daily. It is a stable investment that offers you with an earnings. You just collect your ongoing income (referred to as Cash on Cash Return) on a regular basis and hope to market when the price appreciates considerably and the marketplace is high.

Report this page